by Ilinca Anghelescu, Global Director Marketing & Communications, EW Nutrition

The European Union (EU) agricultural sector is confronted with challenges and uncertainties stemming from the geopolitical risks, extreme weather events, and evolving market demand. The EU Agricultural Outlook 2024-2035, published last month, report highlights the anticipated trends, challenges, and opportunities facing the sector over the medium term, given several considerations likely shaping the future.

Initial considerations for EU agricultural trends

Macroeconomic context

The EU’s real GDP growth is expected to stabilize, contributing to a stable economic environment for agriculture. Inflation rates are projected to return to the European Central Bank’s target of 2% by 2025. Exchange rates will see the Euro slightly appreciating against the US dollar, and Brent crude oil prices are anticipated to stabilize in real terms at approximately $102 per barrel by 2035.

However, despite optimistic declarations in the recent past, we have not solved world hunger. Population growth in lower-income parts of the world is leading to an unequal distribution and, after an initial dip, the number of people going to bed hungry is expected to rise again. Moreover, in the next ten years some improvements are foreseen but no massive changes are expected in the percentage of food groups and calories available per capita.

Climate change impact

Climate change is reshaping EU agriculture by affecting critical natural resources such as water and soil. Agroclimatic zones are shifting northwards, with implications for crop cultivation patterns. For example, regions traditionally suitable for wheat may increasingly shift focus to other crops better adapted to new climate conditions.

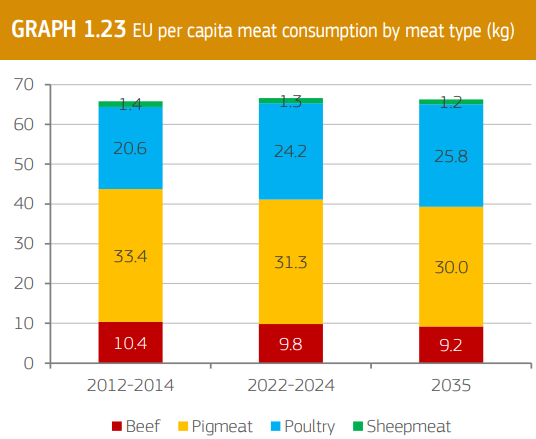

Consumer demand

Consumer awareness of sustainability is driving significant shifts in dietary preferences in the EU. The demand for plant proteins like pulses is increasing, while meat consumption, particularly beef and pork, is declining due to environmental and health concerns. Conversely, demand for fortified and functional dairy products is on the rise.

What are the projected agricultural trends in 2024-2035?

Arable crops

- Land use: While the total agricultural land in the EU remains stable, a shift in crop focus is anticipated. Land allocated for cereals and rapeseed is expected to decline, making way for soya beans and pulses due to reduced feed demand and policy incentives for plant proteins.

- Cereals: Production of cereals, including wheat, maize, and barley, is forecast to stabilize with minor yield increases due to advancements in precision farming and digitalization. Wheat production is set to recover after an expected dip in 2024.

Dairy Sector

- Milk production: Although milk yields are projected to increase due to improved genetics and farming practices, the decline in the dairy cow herd will result in a slight overall reduction in milk production by 2035.

- Dairy products: The production of cheese and whey will grow steadily, driven by domestic and international demand. Conversely, the consumption of drinking milk is expected to decline, while demand for fortified and functional dairy products grows.

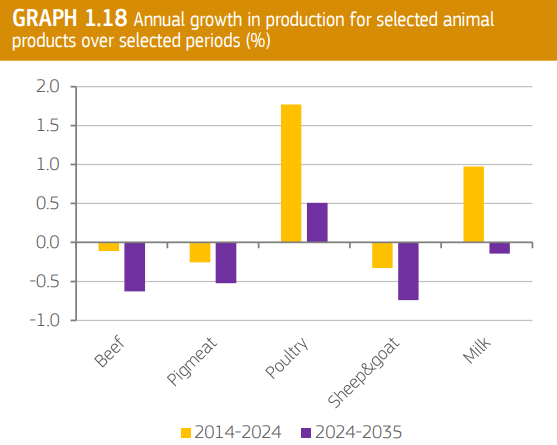

Meat Sector

- Beef and veal: Beef production is expected to decrease by 10%, with the EU cow herd shrinking by 3.2 million head by 2035. This decline is attributed to sustainability concerns, high production costs, and changing consumer preferences. Beef consumption is also projected to decline, driven by high prices and a preference for plant-based alternatives

.

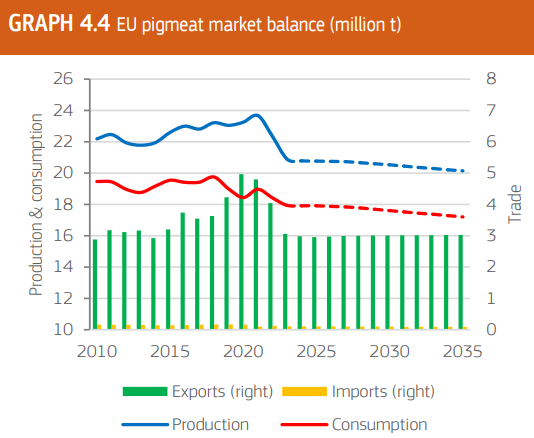

. - Pig meat: The sector faces a projected annual production decline of 0.9%, equating to a reduction of nearly 2 million tons compared to 2021-2023 levels. This trend is largely influenced by concerns over sustainability and a declining preference for fatty meats.

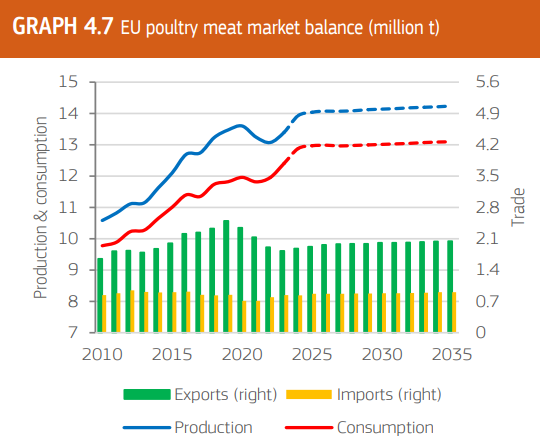

- Poultry: In contrast, poultry production is forecast to increase due to its healthier image, lower cost, and minimal cultural or religious constraints. However, the growth rate will be slower than in the previous decade.

Upcoming challenges in agriculture

Climate Resilience

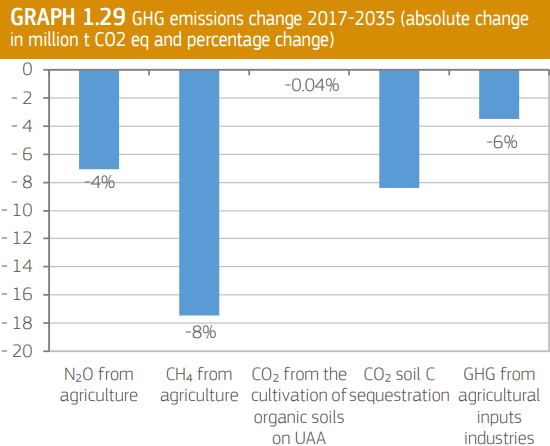

The increasing frequency of extreme weather events requires investments in resilient farming practices. Adoption of precision farming and crop diversification is critical to mitigate climate impacts. However, if existing policies are further implemented, greenhouse gas emissions are expected to see a significant decline.

Policy Frameworks

The Common Agricultural Policy (CAP) plays a pivotal role in steering the sector toward sustainability. However, farmers face challenges in adapting to stricter environmental regulations and securing sufficient funding for transitions. The recent Mercosur agreement has already stirred dissent in EU countries that fear unfettered competition without similar policy regulations.

Market Dynamics

Global trade tensions and competition in agricultural markets pose significant risks. While the EU remains a net exporter, dependence on imports for certain crops, such as soya beans, highlights vulnerabilities in supply chains.

In a weather-shock scenario for the EU feed supply chain, the report highlights that increased feed prices would drive up retail meat prices by 10% for poultry and pork producers, and 5% for beef and veal producers. The increase would be less abrupt for retail prices, rising by 3% for pork, and 4% for poultry meat. Producers need to be mindful of the absorbed costs of these potential shocks.

Conclusion

The EU agricultural sector must continue to balance productivity, sustainability, and consumer preferences. While advancements in technology and policy frameworks offer pathways to resilience, addressing challenges such as climate change and market dynamics will be critical to achieving long-term goals.